I grew up in a middle-class family and witnessed firsthand how finances can make or break a family. While I am not a quote guy but one of it has stuck with me.

Money may not be able to buy you happiness, but a lack of it can certainly ruin it.

Having always faced financial constraints, especially after high school, I developed a keen interest in managing finances. It became more of a necessity than a passion. Over the past ten years, I have read countless books and spent hours on forums, ultimately optimizing my finances in a way that rewards me rather than limits me.

This is not financial advice; rather, it's a way to structure your own financial journey.

Personal Finance System

A system is like an automation for our real-life activities. It's akin to having a personal assistant, albeit one that is invisible to the world. To establish this system, the bare minimum requirement is to set it up. Once you do that, you can let it work for you and keep tweaking it as needed.

We have three components in this system:

Income: This includes all sources of income; think of it as a sea where all streams converge.Investment: This encompasses all valuable assets in the world that appreciate in value, such as real estate, equities, or even antiques.Spending: These are transient items (which doesn't mean they aren't useful or valuable) like food, trips, etc.

To make this system effective, we want to distribute our income between investments and spending in a way that allows us to live the life we desire.

How to Set Up?

Personally, I really enjoy automation, so all my strategies are geared toward that. This setup can be applied in any region where the financial system is digitized.

Incomealways lands in a bank account. If you are a salaried individual, this occurs on a specific day of the month; if you run a business, consider how much you receive in your account each month.

Once the income is in the bank account, I want to automatically send it to two different "pockets" on a specific day:

- Investment

- Spending

- For

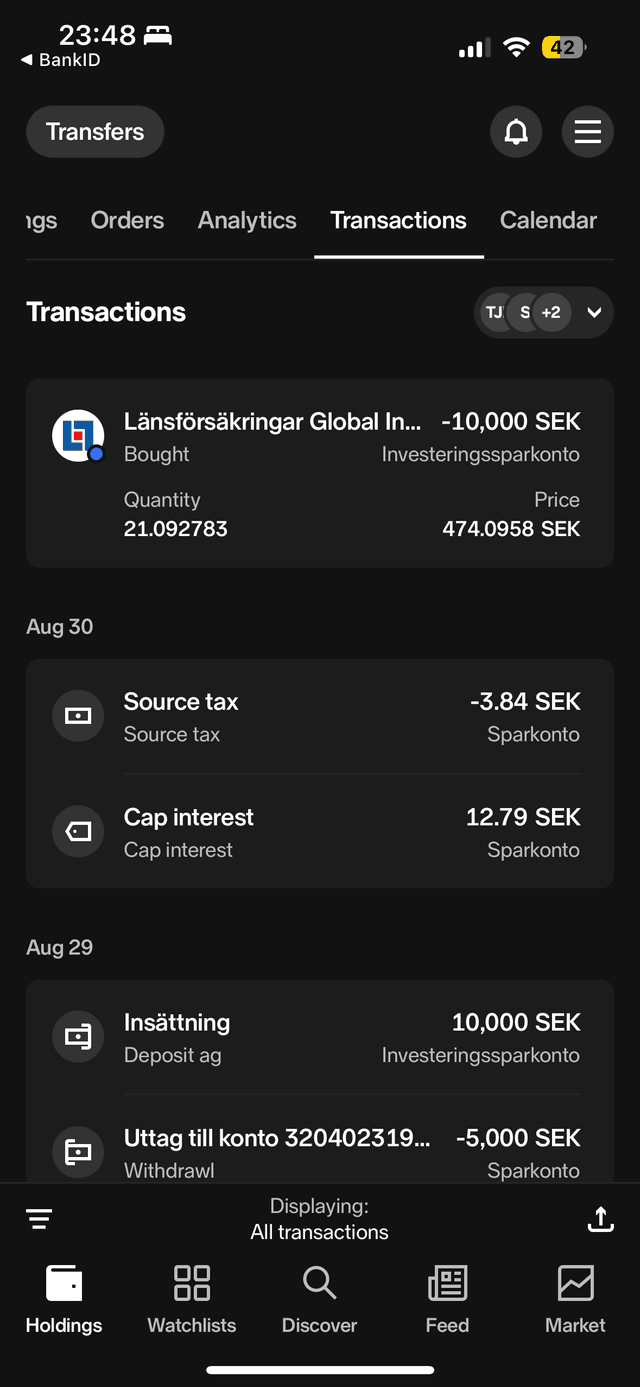

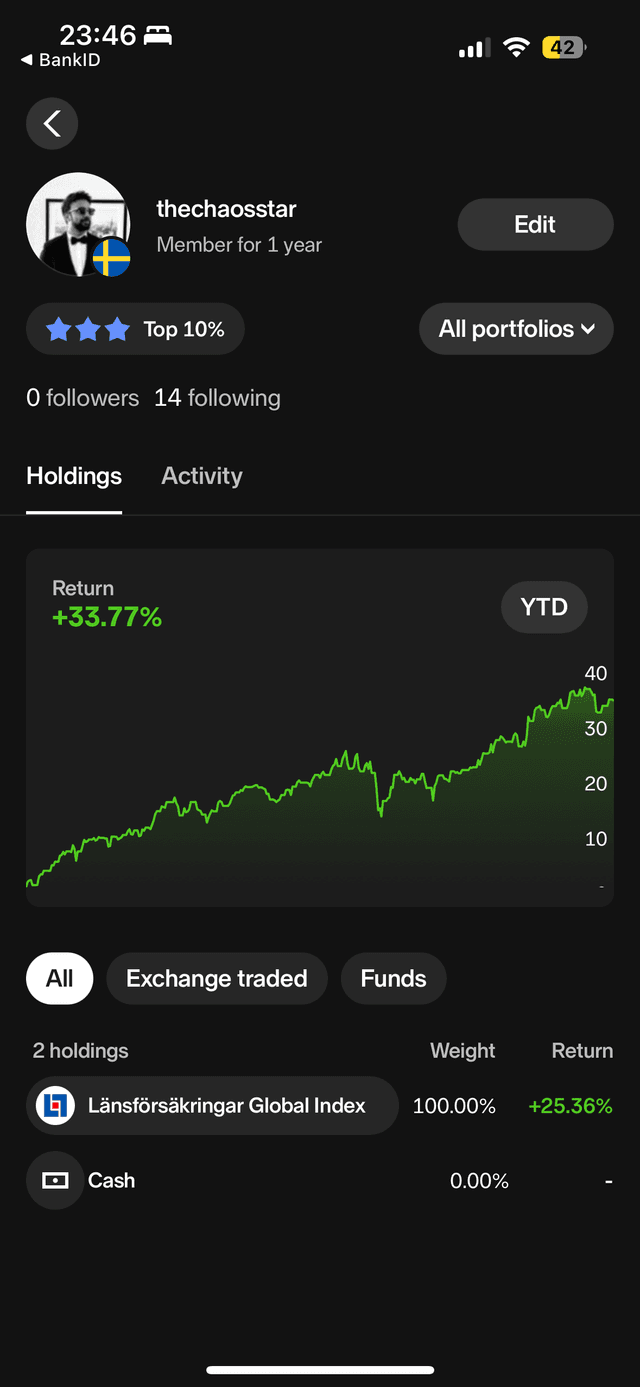

Investment, depending on your preferences, a portion of the money will be transferred for this purpose. For example, I receive my salary on the 25th of every month, and a part of this money is automatically transferred to my investment account (ISK) on the 27th and in following screenshot you can see that got automatically invested into one of the fund.

You can invest in any instrument you prefer, depending on your risk appetite:

- Stocks, Crypto (High Risk)

- ETFs like S&P 500 (Medium Risk)

- Gold or Government Bonds (Low Risk)

- Real Estate, equity in local businesses (depends on your knowledge)

Each of the above may or may not require a separate account.

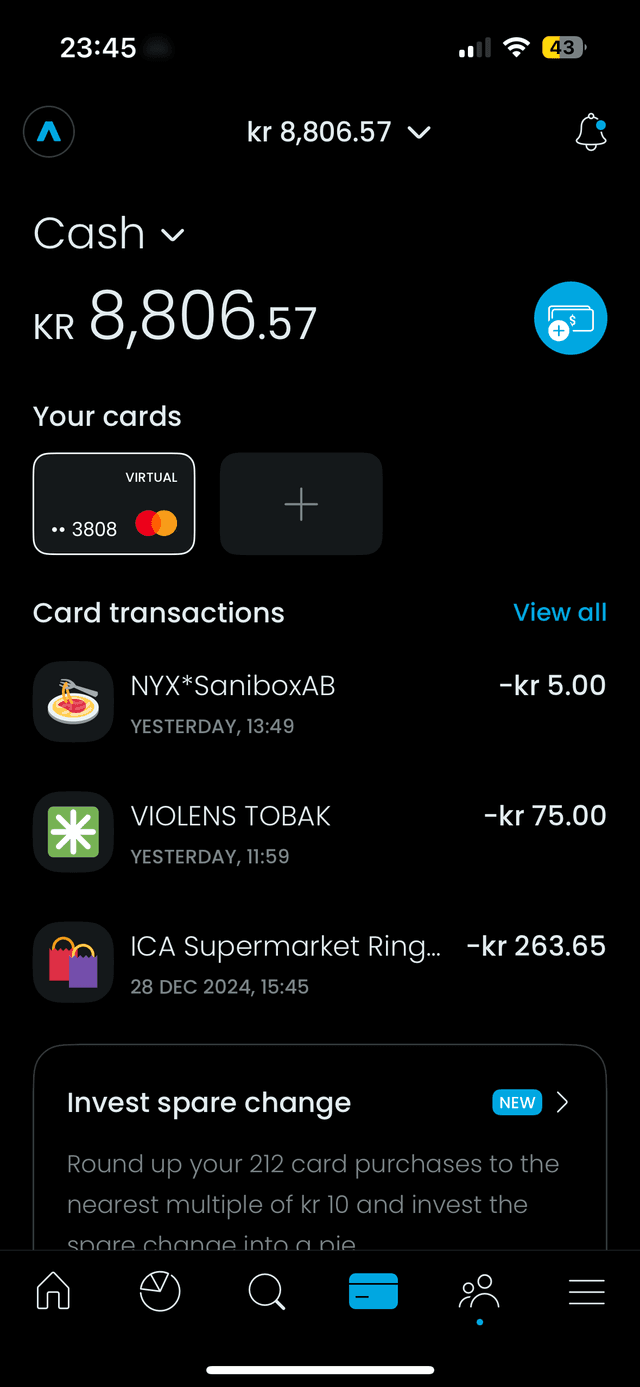

- For

Spending, I also transfer a set amount for my monthly expenses. I don't track individual items because I've learned over time that a budget of around $1000 each month, which includes food, clothes, etc., works for me. I currently use a Trading212 account, but previously I used Revolut.

You can also obtain a credit card with a maximum limit according to your monthly budget, allowing you to enjoy promotional offers.

You really want to do this unless tracking spending becomes a nightmare and easily slips out of control. Keeping separate account for spending creates automatic discipline.

How Not to Break the System?

The system will break when you have:

Income less than (spending + investment)

You must maintain balance. The simple mantra I follow is to live below my means. I learned this lesson the hard way by witnessing my parents' struggles. I can't suggest how you will sperate your income into these two components as every individual is different.

Learning from the Past

- If it's not simple enough for me to understand, I don't invest.

- If it's not useful for long-term financial protection and growth (avoid speculation; I dislike gambling with my hard-earned money).

- I prefer wise investment concepts that can serve as a reference for our financial education journey.

My own Investments

Over the past four years in Sweden, I made two significant investments. First, I purchased an apartment, and with the remaining funds, I invested in a single fund: the Länsförsäkringar Global Index.

Simple just one fund!

Simple Investment Concepts

Here are some concepts I've learned over time. I hope you find them useful.

Long-Only Investing for Retail Investors

- Invest in Stock & Bond ETFs.

- For Sweden, Stock & Bond ETFs include OMX30.

- Use [110 - your age] for high-low risk allocation. For example, I am 30 years old, so 80% will go into high risk and 20% into low risk.

- Rebalance once a year. Buy and sell to maintain your stocks and bonds at that [110 - your age] ratio. ISK in Sweden saves you from taxation nightmares, making it just a click away.

- Consider exposure to other markets for diversification and growth. For this, I invest in Länsförsäkringar Global Index.

- NASDAQ is a growth stock market, while S&P is more focused on fundamental value. NASDAQ has outperformed S&P/Dow over the years.

- If an ETF shuts down, its assets are returned to the shareholders.

- A 100%-equities portfolio is also a bad idea.

- In the long run, an investor's return is measured as earnings per share growth + dividends + changes in valuation (PE ratio).

Lump-Sum Investing / Dollar-Cost Averaging

- If you have a large sum of money to invest, consider investing it all at once or in three portions.

- To minimize buying high, split it into three parts. Invest one part each month until you are fully invested. This way, if the stock goes up, at least you bought some. If the stock goes down, you have cash to buy more at discounted prices.

- Avoid making many trading transactions per month, as that can lead to high trading fees.

Why is Investing in Gold Bad?

- Gold is an unproductive asset; it does not provide dividend yield.

- It relies solely on capital gains.

- Storing physical gold incurs security costs, and a paper gold account requires monthly fees.

- If you still want to invest in gold, consider bonds or ETFs that track gold.

Investment Time Horizon

- If you need the money within a year, it should be in cash or a liquid fund.

- If you need the money within three years, it should be in cash or bonds.

- If you don't need the money within five years, it can go into stocks, ETFs, or crypto—essentially higher-risk options.

ETF or Funds?

- Europeans cannot invest in US ETFs, and particularly in Sweden, it is better to stick with funds.

- Invest in ETFs that actually hold the stocks or bonds they claim, so that in times of distress, such as during the Great Financial Crisis, the ETF won't vanish into thin air.

When to Rebalance?

- Rebalancing at the end of December is not ideal, as liquidity is at its lowest.

- The old adage "Sell in May and Go Away" doesn't hold much validity, but rebalancing in November, after the May-October seasonal weakness, is a good idea if you want a better chance of capturing market turning points.

- If you are rebalancing once a year, I would recommend November.

Which Broker to Use?

- For Swedish stocks, use Avanza or Nordnet.

- For US and other markets, use Interactive Brokers (IB).

- Interactive Brokers is the absolute best.

On Insurance

Mixing protection (essentially insurance) and investment in a product, such as ILP, life insurance, or endowment plans, is a poor idea because these events are mutually exclusive and should not cause liquidation.

- Buy term insurance + personal accident insurance.

- Invest the rest.

- Do not buy life insurance.

- Do not buy ILP (Investment-Linked Products).

Growth-Centric / Dividends-Centric?

- If you are nearing retirement age, opt for dividends-centric stocks or bond ETFs.

- Generally, you buy stocks for growth, not dividends.

One of the most dangerous things an investor can do is seek bond-like returns from the stock market while taking on equity risk on the fixed income side. In simpler terms, this means turning bonds into stocks and stocks into bonds.

Diversify

Hold a diversified portfolio of assets in different countries.

Pro Tips About Trading

Don't trade after hours or in the pre-open. Spreads are wide, and you won't know the "real" price.